.About E-Loans.

Hi, Welcome back to all the viewers to this blog where we are going to discuss How in India Technology completely reformed the scene of taking loans and repaying them online.

Well, recently, I mean maybe yesterday or the day before yesterday, I read a magazine about GST and finance situation in Our Country, So, there, I concluded that current lending technology and like platforms like that is very improved and very much good for our finance, like, they are one of the major factors of stabilizing our GDP.

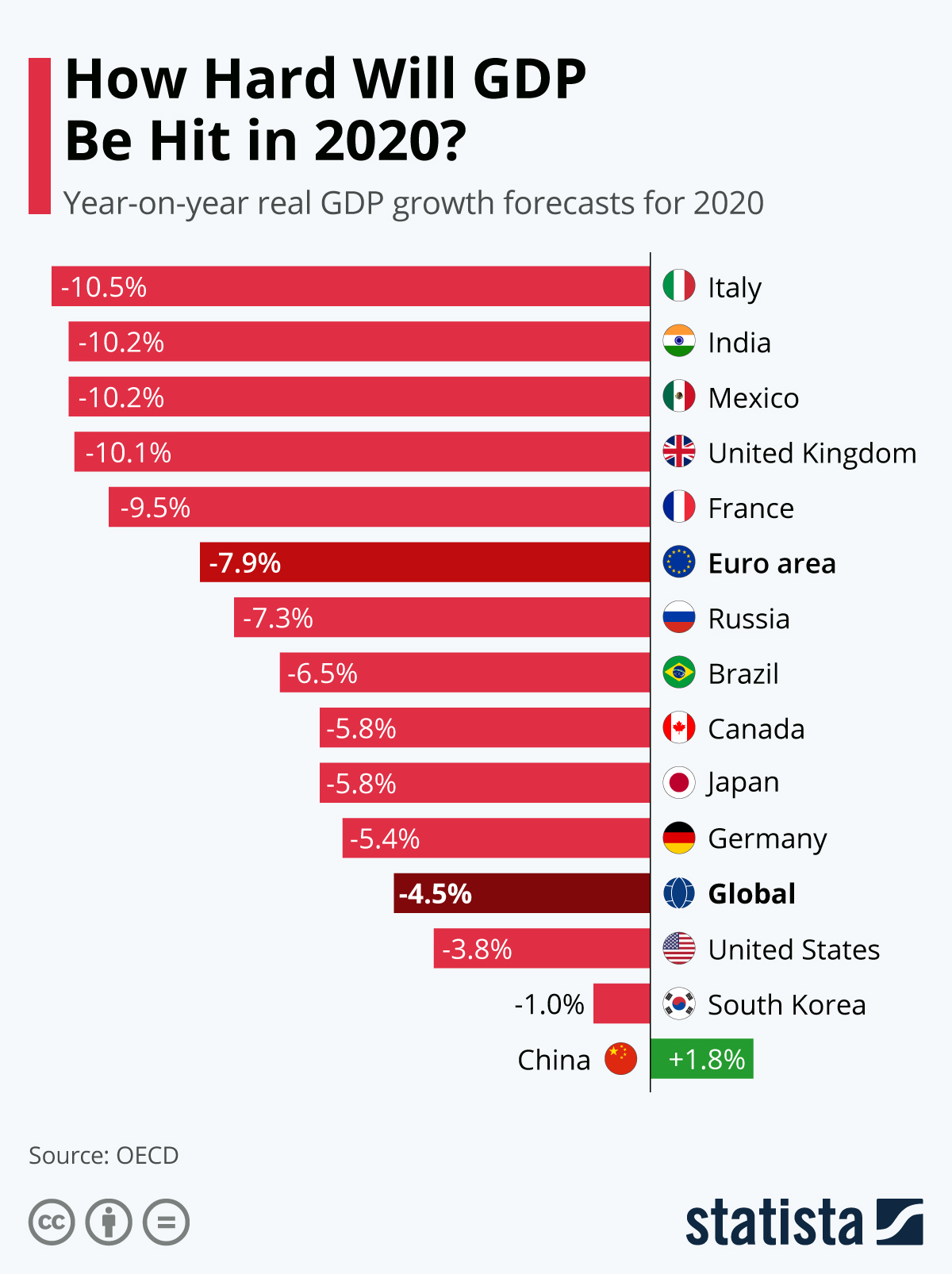

I know GDP is already very negative/down the graph, but still, there are some factors which are bullish for it, preventing it from getting from down to down.

So, We're not going to focus on the negative things anymore in this article, let's talk about How technology is powering digital lending in India.

Earlier, Lot of paper-works was required to get a loan and only those with a good enough source in the loan applying institution or the other case could be those with only complete paperwork can apply for a loan.

It was only limited to educated or rich people, not much was accessed by even 40% of India's population but,

Now, When there is nation-wide transformation occurring, India's loaning industry is quickly changing because of digitization, with complex and tedious credit application cycles of bygone eras being moved up to offer a quicker, safer, and consistent obtaining experience to stay aware of changing client desires. Both conventional FIs like banks and new-age fintech players are riding the digitization wave to offer convincing ease, advanced loaning arrangements.

Digitization of customary loaning originates before the Covid-19 pandemic, which has expanded the inclination for computerized loaning over the face to face communications among borrowers because of cleanliness, comfort, and genuine feelings of serenity. The post-pandemic world will see a more noteworthy interest for online credit.

At the center of this computerized loaning, the blast is innovation, assuming a crucial part in reforming India's credit environment by making elective loaning channels that offer critical focal points to the two moneylenders and borrowers. Banks appreciate the advantages of low operational costs, improved danger appraisal, admittance to new business sectors, income development, better client encounters, and expanded client devotion. Borrowers can appreciate close moment credit with diminished administrative work.

Be that as it may, the main advantage of computerized loaning is helping customarily unserved and underserved client sections access moderate credit.

What More?

Well, with lots of tonnes of reduced paperwork, accessed just through the Internet or Play-Store or App-Store.

These apps are just boon for Indian low class, middle-class person, or those who need loans. But, of course, there are certain things like less-securities and even fraud, etc. which will be the topic for another sequel of this blog.

Let me share some screenshots of those apps which are frequently indexed under the loan app on Play-Store.

So, as you can, there are lots of them, You keep scrolling, You keep getting, But always go for those which are really reliable one, I don't know if in the screenshot how much of them are reliable, but Still always search or ask your elders for some app which they trust.

And I hope whenever you will take an E-Loan, you will do some good from it. Please, make it a boon, not a bane, don't take a loan if you're plan is not to repay or to use the money for your Girlfriend/Boyfriend or for some narcotics.

or else just sleep because,

We will meet in the next Blog until then stay safe BBye:

Meme today:

1 Comments

Comment Down on do you want a Blog on what's most trending going in Science, will be dropping about a science blog very soon!

ReplyDelete